2025 Arizona Affordable Care Act (ACA) Marketplace Open Enrollment Guide

Get ready for

health insurance open enrollment! The Affordable Care Act (ACA) open enrollment period runs from November 1, 2024, to January 15, 2025. This comprehensive guide provides Arizona residents with everything you need to know to navigate the federal health insurance marketplace, understand your health insurance options, and enroll in the right health insurance plan for your needs and budget. When you’re ready to enroll, use our

free AZ ACA Marketplace form to sign up with expert guidance.

Here's what you'll find on this page:

- Key Dates and Deadlines: Don't miss important deadlines! We outline the Open Enrollment Period and Special Enrollment Period details.

- Subsidy Eligibility and Cost-Sharing Reductions: Learn how to qualify for financial assistance to lower your monthly premiums and out-of-pocket costs.

- Understanding Metal Levels: Explore the differences between Bronze, Expanded Bronze, Silver, and Gold plans to find the coverage that fits your needs.

- Arizona's Marketplace Insurance Carriers: Get to know the insurance companies offering plans in Arizona and their unique benefits.

- Step-by-Step Enrollment Guide: We walk you through the enrollment process with clear instructions and helpful tips.

- Frequently Asked Questions: Find answers to common questions about the Arizona Marketplace and Open Enrollment.

Get started today! Contact AZ Health Insurance Brokers for personalized guidance and support throughout the enrollment process. We’re here to help you find the perfect health insurance plan for you and your family.

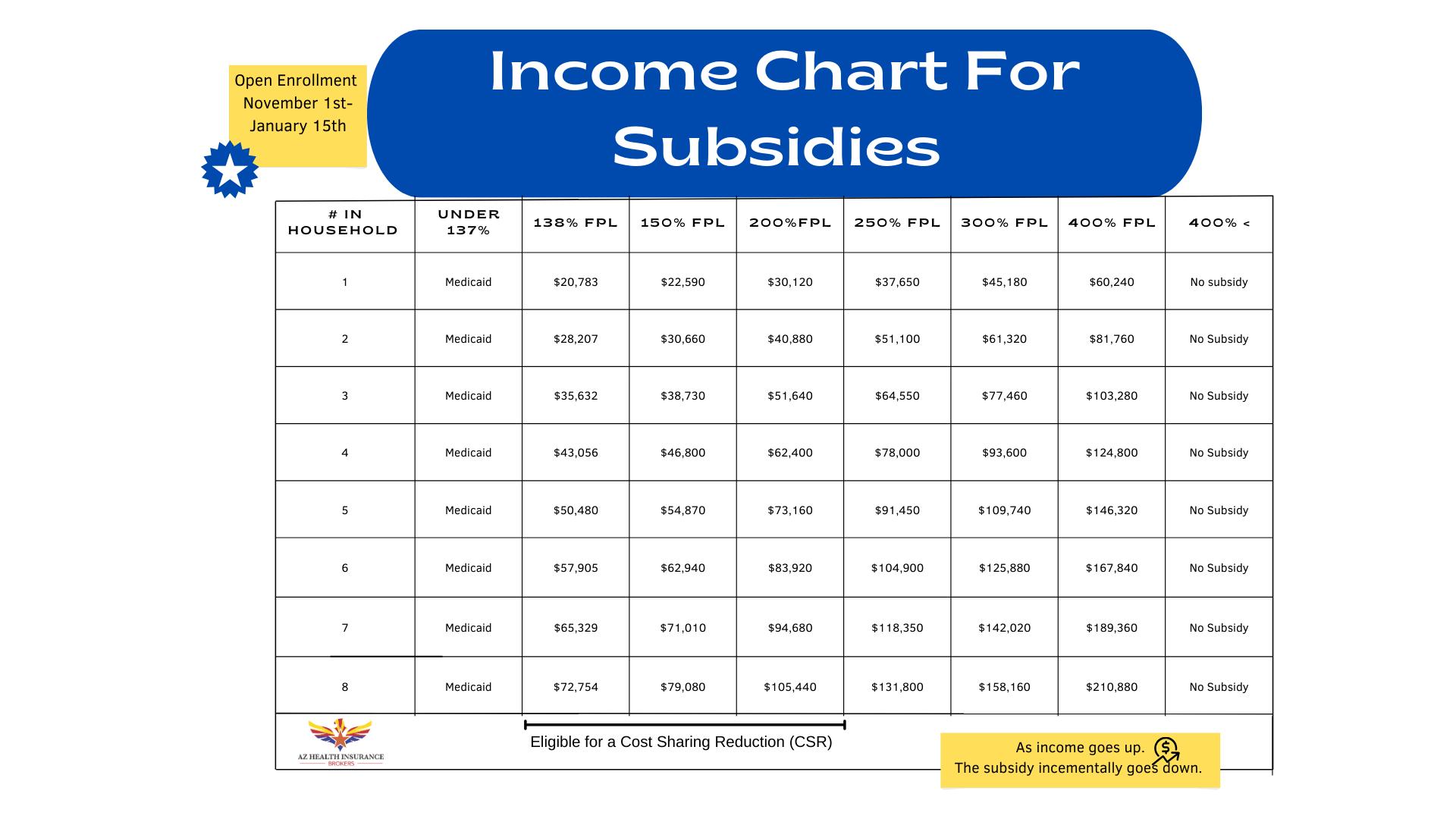

Marketplace Health Insurance Subsidies aka Premium Tax Credits

Most people in Arizona qualify for ACA Marketplace subsidies, also known as premium tax credits, to help lower the cost of their ACA Marketplace health insurance. In fact, about 90% of ACA Marketplace health insurance enrollees in Arizona receive some level of financial assistance based on their income. Even if you don’t qualify for a subsidy, you can still enroll in an ACA Marketplace health insurance plan.

Cost-Sharing Reductions (CSRs)

If your income falls within 138% to 200% of the Federal Poverty Level (FPL), you may qualify for a Cost-Sharing Reduction (CSR). CSRs provide additional savings on Silver tired plans by lowering your copays, deductibles and out-of-pocket maximums. If you’re eligible, choosing a Silver plan with a CSR can make a significant difference in your healthcare costs.

Estimating Your Income and Avoiding Subsidy Repayment

When you’re applying for ACA Marketplace subsidies, you’ll need to estimate your adjusted gross income (AGI) for 2025. This can be challenging, especially for self-employed individuals whose incomes may fluctuate each year. It’s crucial to avoid underestimating your income.

Why? Because the actual subsidy amount is calculated based on your AGI when you file your taxes. If you overestimate your income, and it turns out to be lower, you’ll receive the difference as a refund. However, if you underestimate your AGI, you may have to repay some of the premium tax credit.

Understanding Metal Levels in Arizona's Marketplace Health Insurance

Health insurance

plans on the ACA Marketplace are segmented into “metal” levels: Bronze, Silver, Gold and Platinum. Each tier offers a different balance of monthly premiums and out-of-pocket costs. Let’s explore the key differences.

Bronze Health Insurance Plans

Bronze ACA Marketplace plans typically have the lowest monthly premiums but the highest deductibles and out-of-pocket maximums. Typically, the plan pays 60%, while the insured pays 40%. The deductible is generally high.

What to expect:

- Lower monthly premiums

- Higher deductibles and out-of-pocket maximums

- Copays may apply to primary care physician (PCP) visits, specialist visits, urgent care, outpatient mental health and sometimes bloodwork and physical therapy

- Expenses beyond copays typically apply towards your deductible and out-of-pocket maximum

- Many health savings account (HSA) plans are categorized as Bronze

- Some health insurance plan carriers offer Bronze plans with a $0 deductible, but these may have higher copays. These plans can be a good option if you anticipate an upcoming outpatient procedure

SilveR Health Insurance Plan

Silver ACA Marketplace plans typically offer a balance between monthly premiums and out-of-pocket costs. Typically, the plan pays 70%, while the insured pays 30%. The deductible is generally moderate.

What to expect:

- Higher monthly premiums than Bronze plans

- Lower copays and deductibles than Bronze plans

- Out-of-pocket maximums are usually similar to Bronze plans

- You may qualify for Cost-Sharing Reductions (CSRs) based on your income, which can significantly lower your out-of-pocket costs

- Silver plans are the only tier eligible for CSRs

- With Silver with extra savings plans, the plan pays between 73%-96%, while the insured pays for 6%-27%, depending on how much savings the insured qualifies for

- With Silver with extra savings plans, the deductible is generally low

- Silver plans are a popular choice for those who qualify for CSRs or who want lower deductibles compared to Bronze plans

Gold Health Insurance Plans

Gold ACA Marketplace plans typically have the highest monthly premiums but the lowest out-of-pocket costs. Typically, the plan pays 80%, while the insured pays 20%. The deductible is generally low.

What to expect:

- Highest monthly premiums

- Lowest copays, deductibles and out-of-pocket maximums

- Gold plans are a good option for people with higher medical needs, those who take expensive medications (Tier 3 or Tier 4) or those who prefer more comprehensive coverage

- Gold plans often cover Tier 3 or Tier 4 medications with a copay or after the deductible is met

The ACA Marketplace also offers Platinum plans, which pay 90%, while the insured pays 10%. The deductible is generally low.

What’s the Difference Between Health Maintenance Organizations (HMO) vs. Preferred Provider Organizations (PPO)?

As you browse ACA Marketplace plans, you may see acronyms like HMO and PPO attached to certain plans. These acronyms can affect both how much you pay for a plan, as well as your choice in covered physicians you can see.

Generally, the differences between a health maintenance organization (HMO) and a preferred provider organization (PPO) include:

| Health maintenance organization (HMO) | Preferred provider organization (PPO) |

|---|---|

| Typically lower monthly premiums and lower out-of-pocket costs | Typically higher monthly premiums and higher out-of-pocket costs |

| Requirement to use a primary care physician (PCP), who coordinates care, including specialty care | No PCP requirement |

| PCP must refer in-network specialists | No requirement for a PCP to refer any services |

| No coverage for out-of-network providers, except for true medical emergencies | Able to visit out-of-network providers, though they will require a higher fee and separate deductible |

| No need to file claims | Must file claims for out-of-network provider services |

If you have physicians you want to see, you should check first if a healthcare plan covers them or not. In some cases, this may impact the best choice between an HMO and a PPO.

2 Options for Marketplace Enrollment

AZ Health Insurance Brokers Enrolls You

We make the

ACA Marketplace enrollment process seamless. Fill out our

free form with your information, and we’ll present the best choices based on your budget and healthcare needs. We’ll help you with the enrollment process and be there for guidance whenever you need it.

Enroll in ACA Marketplace Health Insurance on Your Own

We created a step-by-step

guide for enrolling into an ACA Marketplace health insurance plan

on your own.

How to Enroll in ACA Marketplace Health Insurance on Your Own

How to Enroll in ACA Marketplace Health Insurance on Your Own

You can sign up for an ACA Marketplace health insurance plan in minutes. When you sign up for ACA Marketplace health insurance through the

AZ Health Insurance Brokers form, you get a free personalized customer service representative to help with any questions you have and to ensure fast and simple signup. Follow the steps to shop plans and enroll.

2025 Arizona Marketplace FAQ's

Remember, going without health insurance coverage may result in higher out-of-pocket costs for medical care, and you’ll miss out on preventive care benefits. It’s best to enroll during open enrollment or report qualifying life events promptly to avoid gaps in coverage.

If you’ve missed the ACA Marketplace open enrollment deadline, consult with AZ Health Insurance Brokers to explore your options and find the best solution for your situation. Call 602.617.4107 or email info@azhealthinsurancebrokers.com.