Banner|Aetna Health Insurance in AZ Ends in 2026

If you’re enrolled in a Banner|Aetna family health insurance plan or individual healthcare plan through the Affordable Care Act (ACA) federal marketplace in Arizona, it’s important to be aware that the last year these Aetna plans will be active is 2025. Banner|Aetna members on ACA family and individual plans should begin thinking about what health insurance plan they’ll migrate to, whether that’s another plan on the ACA during open enrollment, or to a private health insurance plan through an Arizona health insurance broker, if you want to switch earlier.

Open enrollment on the ACA Marketplace is between November 1 through January 15. Certain life events may qualify you for a special enrollment period, so you may have several options for health insurance in AZ.

This guide explains more about what Banner|Aetna health plans in the ACA Marketplace offered and how to find a new plan with similar benefits. If you’re currently using Banner|Aetna and are interested in changing to another ACA Marketplace plan, contact our team for free expert ACA Marketplace guidance.

Key Takeaways

- Banner|Aetna is a soon-to-be discontinued ACA Marketplace health insurance provider in Arizona. All Banner|Aetna ACA members will need to find a new insurance carrier/plan for 2026 and beyond, since the brand will stop providing individual and family insurance through the ACA Marketplace on December 31, 2025.

- If you want to change to another ACA Marketplace plan, you can do so during open enrollment from November 1 through January 15. You may also be able to change earlier if you qualify for a special enrollment period, or if you change insurance to a private insurer.

- You and/or your family may qualify for subsidies or no-cost insurance through the ACA Marketplace, depending on your household income and if someone in your household has a disability. Talk with an ACA insurance expert for guidance.

Your Next Steps: Navigating the Change from Banner|Aetna

Now that you know Banner|Aetna individual and family plans are exiting the Arizona ACA Marketplace, it's natural to wonder about your next steps for securing health insurance coverage for 2026 and beyond. You generally have two primary paths to consider, and our team is here to help you explore both:

1. Re-shop on the ACA Marketplace During Open Enrollment:

For many current Banner|Aetna members, waiting for the annual ACA Marketplace Open Enrollment Period (OEP) is the most straightforward option. This period typically runs from November 1 through January 15.

Actively Shop, Don't Rely on Auto-Enrollment: While the ACA Marketplace (Healthcare.gov) may automatically enroll you into a comparable plan if you do nothing, it's highly recommended that you actively shop during OEP. An automatically assigned plan may not be the most cost-effective or best fit for your specific health needs and preferred providers.

Compare All Available Carriers: Open Enrollment allows you to compare plans from all other carriers available in your Arizona county, ensuring you find the best value for your budget and healthcare requirements.

Subsidies Still Apply: If you currently qualify for a subsidy or financial assistance based on your income, those same eligibility rules will apply to other ACA Marketplace plans you choose.

2. Explore Private Health Insurance Options:

Another viable path, particularly for those who are relatively healthy and may not qualify for substantial (or any) income-based discounts on the ACA Marketplace, is to consider private health insurance.

Year-Round Enrollment: Unlike the ACA Marketplace, private health insurance plans can often be applied for and secured at any time of the year, providing more flexibility outside of rigid enrollment periods.

Tailored Solutions: Private plans can sometimes offer more tailored benefits, broader provider networks, or different pricing structures that may be more advantageous depending on your health status and financial situation.

Personalized Broker Guidance: Navigating private insurance options can be complex. Our experienced brokers can provide free, personalized quotes and guidance to help you understand if a private plan offers better value or coverage for your unique needs.

Regardless of which path you choose, starting to think about your options now and seeking expert advice can help ensure a smooth transition and the best possible coverage for you and your family.

How Does Banner|Aetna Work for Individual & Family Insurance?

Banner|Aetna is a joint health insurance venture that combines the powers of the Aetna® health insurance company and the Banner Health system. Every ACA Marketplace plan includes coverage for essential benefits, including:

- Preventive and wellness services

- Chronic disease management

- Laboratory services

- Prescription drugs

- Pediatric services, including vision and oral care

- Mental health and substance use disorder services

- Emergency services

- Hospitalization

- Ambulatory services

- Pregnancy, newborn and maternity care

- Rehabilitative and habilitative services and devices

There are also options to add on adult vision and dental insurance coverage, including 100% preventive dental care coverage that includes two yearly cleanings, plus basic and major services. Vision coverage includes a $10 copay eye exam and a $150 allowance for eye care items at select retailers.

In some cases, you may qualify for a subsidy or for no-cost Banner|Aetna ACA Marketplace health insurance. Depending on your and/or your household’s income, as well as if there’s someone in your family with a disability, you could receive a discount or no-cost health insurance. You can use the HealthCare.gov subsidy table to see potential discounts.

Banner|Aetna ACA Metal Tiers

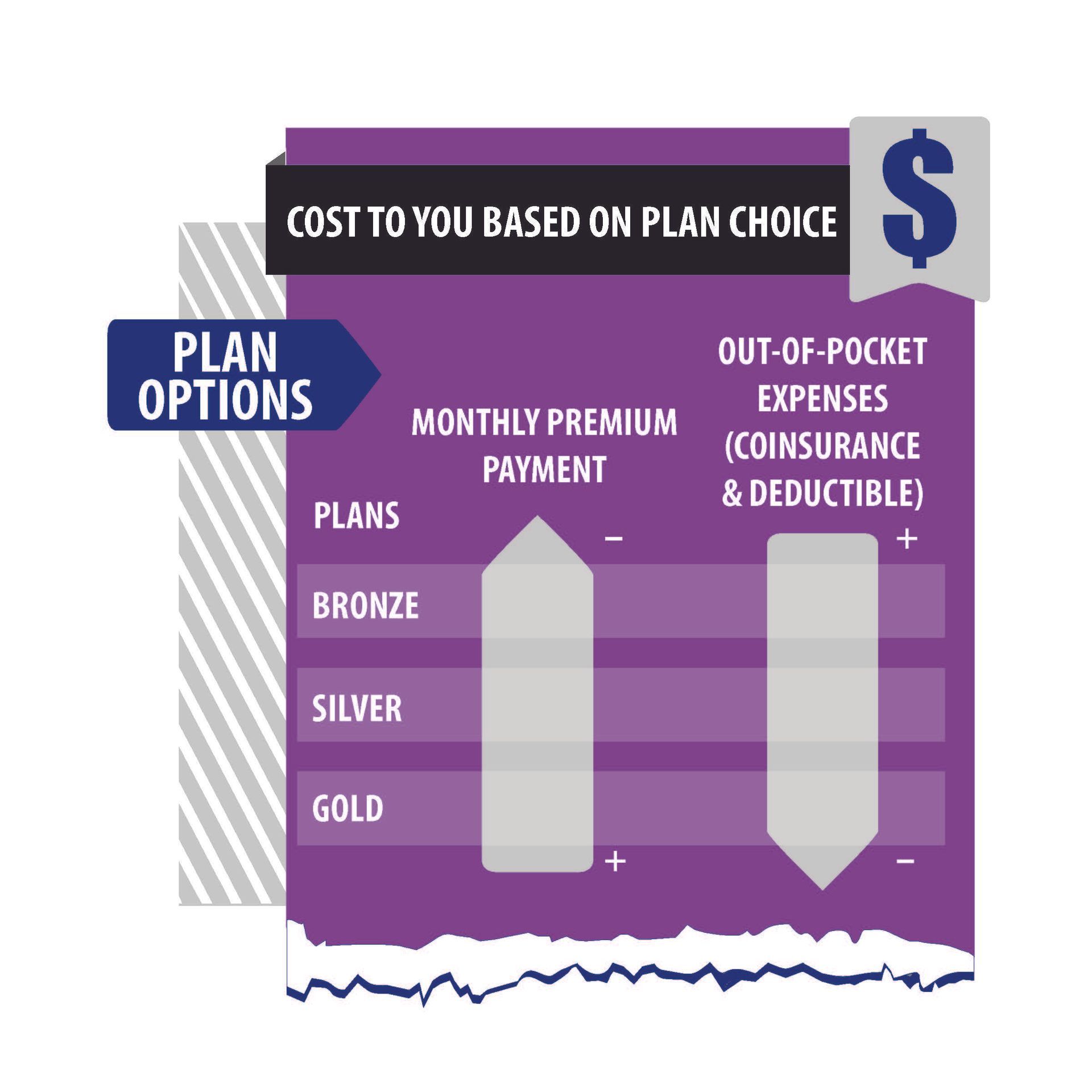

Banner|Aetna ACA plans are assigned a specific metal tier: Gold, Silver or Bronze. These tiers determine how much a plan holder is responsible for in premiums versus cost of care, and how much the insurance plan covers. Generally, the costs you can expect from various metal tiers include the following.

- Bronze: With bronze plans, you’ll pay the lowest in monthly premiums, but you’ll owe more when you do need care. These plans have the highest deductibles of all plans.

- Silver: These plans offer a great balance between how much you’ll pay in monthly premiums and how much you’ll pay when you do need care.

- Gold: Gold plans have higher monthly premium costs than Silver plans, but you’ll pay less when you do need care.

When you’re determining the right metal tier to choose for a Banner|Aetna ACA Marketplace plan, it’s important to consider both how much you want to pay in monthly premiums, and what your anticipated healthcare needs will be over the next year. If you see the doctor regularly, a higher metal tier could help you save overall. If you anticipate only needing emergency and preventive services, a lower tier could work.

How to Get ACA Marketplace Insurance in AZ

If you’re interested in signing up for another insurer on the ACA Marketplace, we can help. Use our free form to see which plans you’re eligible for and to compare costs and benefits. A personalized representative from AZ Health Insurance Brokers will be available to guide you through the signup process and to answer any questions you have.

Remember that while open enrollment begins November 1, you may be eligible for ACA insurance if you qualify for a special enrollment period. If you have any questions about insurance in Arizona at all, we’re here to help. Message us online, call 602.617.4107, or email quotes@azhealthinsurancebrokers.com. We’ll be in touch.

Get a Free Quote for ACA Marketplace Insurance

Banner|Aetna Individual & Family Insurance FAQs

When does Banner|Aetna individual and family ACA insurance end?

Starting January 1, 2026, Banner|Aetna individual and family health insurance plans will no longer be available through the ACA Marketplace.

What should I do if I have Banner|Aetna ACA Marketplace insurance?

If you currently have Banner|Aetna health insurance through the ACA Marketplace, you can get a new ACA health insurance plan during open enrollment from November 1 through January 15. You may also change your insurance outside of open enrollment if you qualify for a special enrollment period. If you’re interested in private health insurance, contact AZ Health Insurance Brokers.

Do I have to get ACA Marketplace insurance if I leave Banner|Aetna?

No. If you had Banner|Aetna ACA Marketplace insurance, you can choose a non-ACA Marketplace plan to migrate to, including private health insurance.

Will I get the same subsidies I had on an old ACA Marketplace plan on my new one?

Yes, it’s possible to get the same subsidies, depending on if your circumstances have remained unchanged. Because subsidies are generally determined by household income or a disability, the same conditions would apply to a new ACA Marketplace plan you apply for.

Can I leave Banner|Aetna now, before it’s discontinued?

You can only get a new insurance plan if you apply within open enrollment for the ACA Marketplace, if you qualify for a special enrollment period with the ACA Marketplace, or if you choose to get a private health insurance plan.

Is Banner|Aetna the same as Aetna?

Yes, Banner|Aetna is an affiliate of Aetna Life Insurance Company and its affiliates, including Aetna.

Does Banner|Aetna require referrals for specialists?

No, you do not need a referral in order to a see a covered specialist if you’re a Banner|Aenta individual/family health insurance plan member.

What are Banner|Aetna out-of-network benefits?

Banner|Aetna individual and family plan holders don’t have out-of-network benefits in any state, other than in case of emergencies. However, all CVS MinuteClinics do offer covered care, since they’re not considered out-of-network, even when they’re outside of the service area. You can also get free virtual healthcare when you need it, wherever you are.

When is open enrollment for health insurance on the ACA Marketplace?

Open enrollment for health insurance on the ACA Marketplace is between November 1 and January 15. If you enroll by December 15, 2025, coverage will start January 1, 2026. If you enroll after December 15, 2025, and by January 15, 2026, coverage will begin February 1, 2026.

What special enrollment periods apply to ACA Marketplace plans?

You may qualify for a special enrollment period to sign up for health insurance on the ACA Marketplace if you experience a special qualifying event, such as moving, divorce, getting married, having a baby, losing health insurance through work, adopting a child, or if your household income falls below a certain amount. Typically, you have 60 days before or 60 days following the event to enroll in an ACA Marketplace plan during a special enrollment period.

How can I enroll in ACA Marketplace insurance?

Fill out the AZ Health Insurance Brokers form to begin the enrollment process for ACA Marketplace health insurance. You can sign up through the form for free, and you’ll gain access to a health insurance expert who can help you through the sign-up process, if you need assistance.

How do I know if I qualify for free health insurance or financial aid for ACA health insurance?

You can input information into the HealthCare.gov subsidy qualification table to see if you may qualify for a discount, subsidy or free health insurance through the ACA Marketplace. You can also directly contact AZ Health Insurance Brokers to check if your income impacts potential discounts.

How can I ensure I’m selecting the right ACA Marketplace plan?

Use the free ACA Marketplace sign-up form provided by AZ Health Insurance Brokers. You’ll quickly get free expert help from an insurance professional who can help you through the sign-up process and assist with choosing a Banner|Aetna ACA Marketplace plan that fits your budget and your and/or your family’s healthcare needs.

What are the pros of Banner|Aetna ACA Marketplace health insurance?

One pro of Banner|Aenta ACA Marketplace health insurance is that you don’t need a referral to visit a healthcare specialist. Banner|Aetna ACA Marketplace health insurance can also be a good option for frequent travelers, because you get free virtual healthcare and can use the plan at CVS MinuteClinic locations outside of Arizona. Banner|Aetna health insurance plans are also contracted with the Arizona Banner Health Network of hospitals, as well as providers including Sonora Quest Laboratories and HonorHealth hospitals.

What are the cons of Banner|Aetna ACA Marketplace health insurance?

Like many ACA Marketplace plans, to receive plan benefits, you must use a provider who’s covered by the plan. Out-of-network coverage is only applicable to emergencies.