UnitedHealthcare 2026 ACA Individual & Family Health Insurance Explained

With the largest market share in the country, as reported by the American Medical Association, UnitedHealthcare is a prominent name among Arizona insurers. The company has partnered with the Arizona Care Network, which includes Dignity Health, Abrazo Health and the Phoenix Children’s Care Network. Many residents are familiar with UnitedHealthcare, especially since it’s one of the top health insurance choices for employers to offer for group health insurance, as well.

If you’re an individual in need of health insurance coverage for yourself and/or your family, and you’re not getting coverage through your work, you may be wondering about you options and whether or not UnitedHealthcare is a good fit for you. UnitedHealthcare has options for individuals who are between jobs, who just turned 26 and need short-term insurance while they look for a permanent option, who are self-employed and need health insurance, and who are looking for alternatives to the health insurance their employer offers.

For individuals and families, UnitedHealthcare offers some diverse product offerings that could be of interest. In this article, learn about what UnitedHealthcare individual and family health insurance products are available to decide if one or more could be the right fit for your

individual health insurance or

family health insurance choice.

Key Takeaways

- UnitedHealthcare offers a variety of family individual insurance products to choose from, including short-term health insurance in Arizona, family and individual Affordable Care Act (ACA) Marketplace plans, hospitals and doctor insurance, hospital indemnity insurance and other types.

- UnitedHealthcare also offers family individual dental insurance products and family individual vision insurance products for Arizona residents.

- To talk through all your family and individual health insurance options, including with UnitedHealthcare, schedule a free consultation with an Arizona health insurance broker.

Arizona Health Insurance Products Offered by UnitedHealthcare

Short-Term Health Insurance in Arizona

UnitedHealthcare offers budget-friendly short-term healthcare coverage options, with monthly payment plans. These can be a good option if you’re searching for permanent individual health insurance and need coverage while you search.

Individual & Family ACA Marketplace Plans

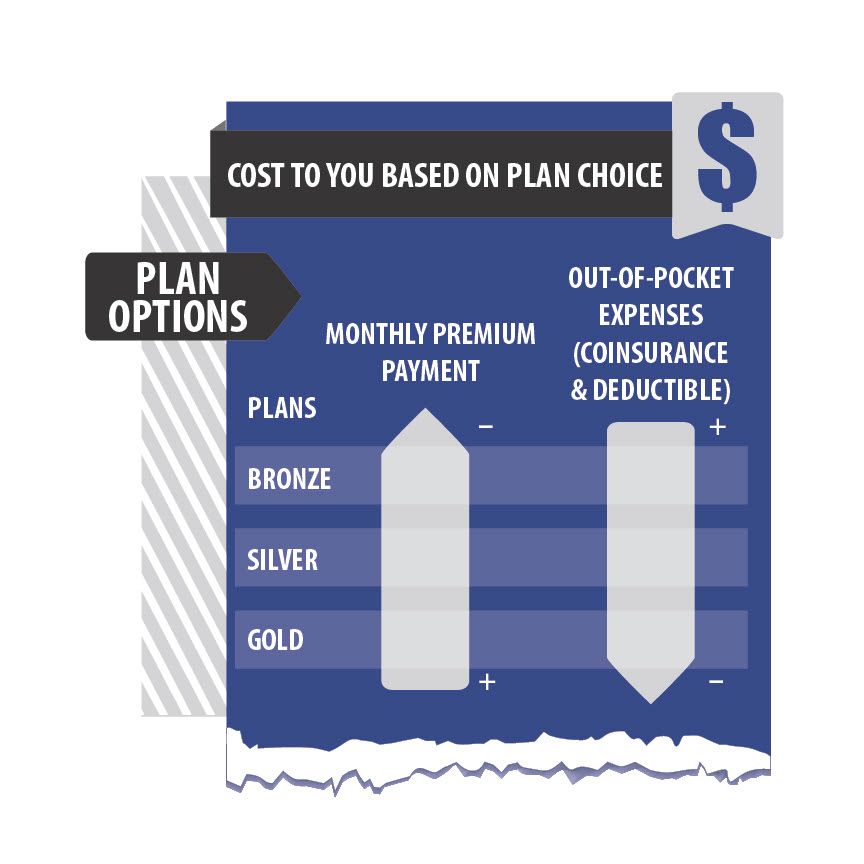

UnitedHealthcare offers individual and family health insurance plans on the ACA Marketplace. These plans are classified into five plan categories, each of which have different levels that explain cost division between the planholder and UnitedHealthcare.

UnitedHealthcare 2025–2026 Rate Changes in Maricopa County

UnitedHealthcare’s ACA Marketplace premiums in Arizona increased across all metal tiers from 2025 to 2026. On average, prices rose between 41% and 47%, depending on the plan level.

| Metal Tier | 2025 Avg. Premium* | 2026 Avg. Premium* | % Change |

|---|---|---|---|

| Bronze | $325.16 | $459.02 | 0.41 |

| Silver | $392.64 | $577.46 | 0.47 |

| Gold | $466.74 | $679.69 | 0.46 |

*Average monthly premium before subsidies for a 40 year old, based on Maricopa County Marketplace rates.

Takeaway:

UHC’s rates increased more than the statewide average, but their network breadth and plan variety (Standard, Essential, Copay Focus, and Advantage) still make them a strong contender for families who prioritize Banner and Abrazo facilities or nationwide brand stability.

UnitedHealthcare plans include:

- Standard: These ACA healthcare plans offer a good balance of coverage and affordability. You’ll have copays for primary care physicians (PCPs), specialists and urgent care, while other expenses are subject to your deductible and out-of-pocket maximum.

| UHC Standard Gold, Silver & Bronze |

|---|

| Deductible | Out-of-pocket maximum | Coinsurance | Primary care physician (PCP) copay | Specialist copay | |

|---|---|---|---|---|---|

| Gold | $2,000.00 | $8,200.00 | 75%/25% | $30 | $60 |

| Silver | $6,000.00 | $8,900.00 | 60%/40% | $40 | $80 |

| Bronze | $7,500.00 | $10,000.00 | 50%/50% | $50 | $100 |

- Essential: This is the most affordable option, with all medical expenses applying towards the deductible. It’s a good fit for those who rarely need medical care and who want catastrophic coverage for major accidents or illnesses.

| UHC X Essential |

|---|

| Deductible | Out-of-pocket maximum | Coinsurance | Primary care physician (PCP) copay | Specialist copay | |

|---|---|---|---|---|---|

| Gold | $2,000.00 | $8,200.00 | 75%/25% | $30 | $60 |

| Silver | $6,000.00 | $8,900.00 | 60%/40% | $40 | $80 |

| Bronze | $7,500.00 | $10,000.00 | 50%/50% | $50 | $100 |

- Copay Focus: Copay Focus plans have slightly higher monthly premium costs but a $0 deductible, which means health insurance plan coverage kicks in immediately. With this plan, you pay fixed copays.

| UHC Copay Focus |

|---|

| Deductible | Out-of-pocket maximum | Coinsurance | Primary care physician (PCP) copay | Specialist copay | |

|---|---|---|---|---|---|

| Gold | $0.00 | $7,800.00 | Specific Copays until OOP Max | $30 | $60 |

| Silver | $0.00 | $10,600.00 | Specific Copays until OOP Max | $40 | $80 |

| Bronze | $0.00 | $10,600.00 | Specific Copays until OOP Max | $50 | $100 |

- Advantage: These plans offer low deductibles and include adult dental and vision benefits. After you meet the deductible, copays continue to apply towards the out-of-pocket maximum.

| Deductible | Out-of-pocket maximum | Coinsurance | Primary care physician (PCP) copay | Specialist copay | |

|---|---|---|---|---|---|

| Gold | $1,250.00 | $8,000.00 | Specific Copays until OOP Max | $10 | $60 |

| Silver | $4,500.00 | $10,150.00 | Specific Copays until OOP Max | $12 | $80 |

**Remember**: These are just highlights. Review the full plan details on the UHC website, and consider your individual needs and budget before making a decision.

Individuals can sign up for UnitedHealthcare ACA plans with no restrictions for pre-existing conditions. ACA

health insurance enrollment typically begins November 1 each year and lasts until January 15 the following year. Certain qualifying events, such as divorce or loss of insurance through work, can also trigger

special enrollment periods.

Individuals can sign up for UnitedHealthcare ACA plans with no restrictions for pre-existing conditions. ACA

health insurance enrollment typically begins November 1 each year and lasts until January 15 the following year. Certain qualifying events, such as divorce or loss of insurance through work, can also trigger

special enrollment periods.

When you’re considering a UnitedHealthcare individual or family health insurance plan, it’s essential to understand their hospital network in Arizona. For 2025 and beyond, there’s a notable change: UHC is no longer contracted with HonorHealth on ACA Marketplace plans.

Here’s a breakdown of UHC’s hospital network by Arizona county:

Maricopa County: Abrazo Health, Banner Health, Steward, Valleywise, Adelante Healthcare, Native Health, Valle del Sol, Wesley Community & Health Centers

Pinal County: Banner Health, Steward, Gila River Healthcare

Gila County: Banner Health, Cobre Valley Regional Medical Center, New Pioneer Medical Associates, ABC’s Pediatrics

Pima County: Carondelet Health Network, Banner Health, Northwest Healthcare, El Rio Health

Mohave County: Kingman Regional Medical Center, Western Arizona Regional Medical Center, North Country HealthCare

La Paz County: La Paz Regional Hospital

To confirm your preferred hospitals and doctors are in-network, use the following resource:

UHC Provider Lookup Tool: https://www.uhc.com/lp/aca-marketplace/gt-az

UnitedHealthcare’s Prescription Drug Coverage (Formulary)

Understanding which medications are covered by your health insurance plan is crucial. You can access United Healthcare’s formulary (list of covered drugs) through the following link:

UHC Formulary:

Hospital & Doctor Insurance

UnitedHealthcare provides Health ProtectorGuard fixed indemnity insurance to supplement a major medical plan. The program, underwritten by Golden Rule Insurance Company, pays cash for eligible, covered medical services, such as a surgical procedure, a trip to urgent care or a doctor visit. It also offers money to pay for expenses not covered by major medical plans, such as a deductible.

Dental Insurance

You can get coverage for dental services medical insurance plans don’t include, with no age limit restrictions, through a dental insurance plan provided by UnitedHealthcare, underwritten by Golden Rule Insurance Company.

Vision Insurance

You can also get vision insurance for services not covered by medical insurance plans. These are also underwritten by Golden Rule Insurance Company and have no age restrictions.

Accident & Critical Illness Insurance

These supplemental insurance plans offer financial coverage for expenses related to accidental injury and treatment, heart-related illness, cancer and other critical illnesses.

How to Get Individual Insurance Coverage Through UnitedHealthcare

If you’re interested in using UnitedHealthcare as your Arizona individual insurance provider for short-term insurance, ACA coverage or another type of insurance plan, contact AZ Health Insurance Brokers. We can help you secure individual health insurance that fits your unique individual needs and budget.

Email quotes@azhealthinsurance.com, call 602.617.4107 or contact us online, and we’ll be in touch.

UnitedHealthcare Individual Insurance FAQs

What individual health insurance plans does UnitedHealthcare offer in Arizona?

In Arizona, individuals can get short-term health insurance, ACA Marketplace insurance, hospital and doctor insurance, dental insurance, vision insurance, accident insurance and critical illness insurance coverage through UnitedHealthcare.

What types of ACA Marketplace plans does UnitedHealthcare offer?

UnitedHealthcare’s ACA Marketplace plans include Standard, Essential, Advantage and Copay Focus plans. Each category includes “metal” levels (bronze, silver and gold, for example) that explain how expenses are divided between UnitedHealthcare and the planholder.

What do short-term insurance plans from UnitedHealthcare include?

UnitedHealthcare short-term insurance plans offer benefits with limited coverage for a limited time. These types of plans are ideal for candidates who are experiencing a gap in healthcare coverage, such as when you’re in-between jobs, or you’re waiting for permanent healthcare coverage to begin.

What are the benefits of an ACA Marketplace plan through UnitedHealthcare?

An ACA Marketplace plan through UnitedHealthcare may make sense if you qualify for a government subsidy or premium tax credit based on income. For individuals with pre-existing conditions, ACA Marketplace plans may also be a good option, because you won’t be denied for a plan because of a pre-existing condition.

Why should you consider UnitedHealthcare for individual insurance?

As one of the largest health insurance providers in the United States, UnitedHealthcare has a strong provider network and numerous resources for members. UnitedHealthcare is a popular insurance option in Arizona because of its coverage options, but plans may also be more expensive compared to insurance plans offered by other brands, depending on your healthcare needs.

When is open enrollment for UnitedHealthcare ACA Marketplace plans?

Open enrollment for UnitedHealthcare ACA Marketplace plans is November 1 through January 15 each year. If you enroll by December 15, your coverage will begin on January 1. If you enroll after December 15, your coverage will begin February 1.

Can I sign up for UnitedHealthcare ACA Marketplace insurance outside of open enrollment?

You may be able to sign up for UHC ACA Marketplace health insurance outside of open enrollment if you qualify for a special event. These generally include life events such as moving, getting married, having a baby, or losing healthcare coverage through work.

How can you enroll in UnitedHealthcare ACA Marketplace insurance?

Contact a health insurance broker at AZ Health Insurance Brokers for free help enrolling in an ACA Marketplace plan like UnitedHealthcare. You’ll get a free comparison of all plans that work for you and assistance in the enrollment process.

What benefits do UnitedHealthcare ACA Marketplace plans include?

All UnitedHealthcare ACA Marketplace plans include ambulatory patient services, emergency services, pregnancy and newborn care services, hospitalization, prescription medicine, laboratory services, preventive and wellness services, pediatric services and rehabilitative services and devices.

How does UnitedHealthcare compare to other ACA Marketplace plans?

In addition to offering common ACA Marketplace benefits, UHC plans also offer $0 virtual urgent care, 24/7 live chat with member advocates, prescriptions starting at $10, $250 in rewards for completing health-related activities and low-cost virtual mental health visits.