Cigna Health Insurance in Arizona 2026: Everything You Need to Know

In Arizona, one of the most popular insurance companies around is Cigna HealthCare of Arizona. It’s offered through group health insurance by many Arizona employers, and it’s also available for individuals and families seeking coverage. You can also compare all 2026 Arizona Marketplace carriers here.

During open enrollment for the federal Affordable Care Act (ACA) Marketplace, you can sign up for Cigna individual or family insurance between November 1 and January 15. Special qualifying events may also trigger a special enrollment period at any time of year.

For individuals and families looking for insurance, Cigna health insurance tends to be more expensive compared to other carriers on the ACA Marketplace. But for people who have preferred doctors who are covered by Cigna, and/or they’re taking an expensive medication that Cigna healthcare offers coverage for, Cigna may be a good ACA Marketplace choice.

In this blog, learn more about what to expect from Cigna ACA Marketplace plans in Arizona. When you want to compare your ACA Marketplace options, fill out our

free form. You’ll see pricing and coverage comparisons and will get access to a free ACA Marketplace liaison who can help you with any questions you might have.

Key Takeaways

- While Cigna is a reputable insurer with comprehensive healthcare coverage for a variety of needs, for individuals and families looking for insurance, Cigna’s ACA Marketplace pricing tends to be more expensive compared to other carriers. In Arizona, Cigna is generally an ideal choice if you have a preferred doctor who’s covered by Cigna, or you’re taking an expensive prescription that Cigna covers, but other plans don’t.

- With Cigna health insurance plans, you don’t need a referral from a primary care physician to see a specialist. This can be a convenient benefit that puts more healthcare choice in members’ hands.

- In Arizona, Cigna’s lab network includes Sonora Quest Laboratories, Labcorp and Evernorth. Cigna is also contracted with several Arizona healthcare providers, including Barrow Neurological Institute, Dignity Health, HonorHealth and KPC Promise Hospital of Phoenix.

Who Cigna Is Best For in Arizona

- Individuals who already use Cigna doctors or Dignity/HonorHealth facilities

- People who prefer

no-referral plans for specialist visits

- Families managing diabetes or chronic care who benefit from Cigna’s support programs

- Consumers prioritizing telehealth and national brand recognition

Cigna ACA Health Insurance for Individuals & Families

Cigna offers many benefits worth considering when you’re shopping for ACA Marketplace insurance for individuals or families. Some of the advantages Cigna offers include:

- Variety of prices among plan choices: In addition to $0 preventive care across all plans and $0 copays for generic drugs and virtual care, Cigna also offers $0 deductible plans.

- Rewards programs: Cigna provides the Cigna Take Control Rewards® program, which enables members to earn points redeemable for a Reloadable Reward Card, which can be used for healthcare expenses. The Cigna Healthy Rewards® Program provides discounts on health products and programs.

- Diabetes assistance: Members with diabetes can lower out-of-pocket costs by 40% or more. Benefits include: a maximum of $25 for a 30-day supply or $75 for a 90-day supply of insulin and some medications for type 2 diabetes; $0 for diabetes supplies on the Cigna Healthcare prescription list; $0 for select labs and exams; and $0 for diabetes management training.

- 24/7 virtual care: Free medical and behavior virtual care is available at any time of day or night.

- My Personal Champion® program: The free My Personal Champion® program is available to members who have highly complex, specialized conditions or several health circumstances that need extra attention. Members in this program receive a “personal” champion who can provide health benefit education, oversight of benefits application, help identifying local resources and other services.

As one of the

largest health insurance providers in the country and in Arizona, Cigna has lots of helpful resources for members. For those with unique health conditions or who have diabetes or other specialized care needs, Cigna could be a good option, based on the resources the insurer provides.

What Types of Cigna ACA Marketplace Plans Are Available?

Cigna offers ACA Marketplace plans on bronze, silver and gold metal tiers. Average premiums have risen from 2025 to 2026, based on rates for a 40-year-old individual in Maricopa County.

- Connect Bronze: Bronze plans have the lowest monthly premiums but the highest out-of-pocket expenses. You may be eligible for premium tax credits to help with the cost.

| Metal Tier | 2025 Avg. Premium* | 2026 Avg. Premium* | % Change |

|---|---|---|---|

| Bronze | $441.11 | $500.63 | +12% |

| Silver | $483.33 | $657.32 | +36% |

| Gold | $597.77 | $749.21 | +25% |

* Based on unsubsidized monthly premiums for a 40-year-old individual in Maricopa County. Actual rates vary depending on age, income, tobacco use, and household size.

Tayler Busack with AZ Health Insurance Brokers

“We’ve seen Cigna remain a strong option for Arizonans who want access to Cigna, Dignity, or HonorHealth facilities without needing a referral to see a specialist. Even though this year’s prices have gone up, the pricing is more in line with the other carriers this year.”

Each tier has different costs and benefits, so it’s important to understand the differences to choose the right plan for your needs.

| Cigna Connect CMS Gold, Silver & Bronze |

|---|

| Deductible | Out-of-pocket maximum | Coinsurance | Primary care provider copay | Specialist copay | |

|---|---|---|---|---|---|

| Gold | $2,000 | $8,200 | 75%/25% | $30 | $30 |

| Silver | $6,000 | $8,900 | 60%/40% | $40 | $80 |

| Bronze | $7,500 | $10,000 | 50%/50% | $50 | $100 |

| Cigna Connect Indiv Med. Gold, Silver & Bronzer |

|---|

| Deductible | Out-of-pocket maximum | Coinsurance | Primary care provider copay | Specialist copay | |

|---|---|---|---|---|---|

| Gold | $2,500 | $8,200 | 75%/30% | $5 | $30 |

| Silver 6100 | $6,100 | $8,500 | 50%/50% | $20 | $70 |

| Silver 4000 | $4,000 | $9,700 | 60%/40% | $8 | $60 |

| Bronze 7400 | $7,400 | $10,600 | 50%/50% | After meeting the deductible, no charge | After meeting the deductible, no charge |

| Bronze 9500 | $9,500 | $9,500 | After meeting the deductible, no charge (there is a $2,300 charge per day for hospital stays) | $60 | $95 |

Generally, the differences between these plans are as follows.

- Bronze: Bronze plans have the lowest monthly premium costs but the highest out-of-pocket expenses. Members on these plans may be eligible for premium tax credits, based on factors like income.

- Silver: Silver plans are ideal for families and individuals who see doctors regularly. These plans provide a middle balance of premium costs and out-of-pocket expenses and offer premium tax credit eligibility, as well as potential cost-sharing reductions.

- Gold: Gold plans are best for individuals and families who see doctors frequently and who take multiple prescription medications. These plans have the highest monthly premium but the lowest out-of-pocket expenses on healthcare. They’re also potentially eligible for premium tax credits.

When you’re deciding on your Cigna metal tier, you’ll want to consider how frequent your healthcare needs are, how much you want to pay each month on a premium, and how much you’re willing to pay out-of-pocket for healthcare costs. When you fill out our free ACA Marketplace form, our professional representative can guide you through which Cigna metal tier might be the best choice for your unique situation.

Because Cigna is one of the more expensive ACA Marketplace choices in Arizona, it may be a good idea to compare it with other plans before signing up for Cigna on the ACA Marketplace. You could potentially get similar benefits on a less expensive plan. Our team can help guide you.

How to Sign Up for Cigna on the ACA Marketplace

Open enrollment for Cigna and all ACA Marketplace plans begins on November 1 and lasts through January 15. When you’re ready to sign up for an ACA Marketplace plan, use our form. You’ll be able to see all plan options and prices and will get a dedicated representative to help every step of the way.

If you want your ACA Marketplace insurance coverage to begin January 1, 2026, make sure to sign up by December 15. If you sign up for health insurance after December 15 through January 15, your coverage will begin February 1, 2026.

There are also special qualifying events that may enable you to sign up for an ACA Marketplace plan at any time of year. These include moving, having a baby, adopting a child, getting divorced, and having your household income fall below a certain amount. If you want to see if you qualify, fill out our form.

Have questions about

Arizona health insurance overall? The

AZ Health Insurance Brokers team is ready to provide assistance. We can walk you through all your health insurance options, with no obligation, so you can understand your choices before deciding on a plan.

Contact us online, email

quotes@azhealthinsurancebrokers.com or call 602.617.4107 for more information.

Cigna ACA Marketplace Individual & Family Insurance FAQs

Is Cigna part of Marketplace health insurance?

Yes, you can purchase Cigna health insurance on the Affordable Care Act (ACA) Marketplace during open enrollment from November 1 through January 15, as well as at any time of year if you qualify for a special enrollment period.

Is Cigna a good insurance plan?

Cigna is one of the top health insurers in the U.S., especially for group health insurance plans. For individuals and families, Cigna may be a good insurance choice if the insurer covers your preferred doctors and/or you have prescriptions covered by Cigna.

=

Is Cigna health insurance expensive?

For individuals and families in Arizona, Cigna ACA Marketplace health insurance plans tend to be more expensive compared to other individual and family health insurance plans on the ACA Marketplace. Cigna may be worth it if the insurer offers coverage for your preferred physicians and/or prescriptions.

What is not covered by Cigna?

Cigna health insurance does not cover out-of-network healthcare providers (except for treatment of an emergency medical condition), services or supplies that aren’t medically necessary, custodial care, dental and orthodontic services, hearing aids, cosmetic services and a variety of other services.

How can I sign up for Cigna on the ACA Marketplace?

Use the ACA Marketplace free form to sign up for Cigna on the ACA Marketplace and get options for all ACA Marketplace health insurance providers and prices.

What metal tiers are offered by Cigna?

Cigna offers plans on the bronze, silver and gold metal tiers. The bronze plans have the lowest monthly premiums but the highest out-of-pocket costs. The silver plans offer a balance between monthly premium and out-of-pocket costs. The gold plans have the highest monthly premiums and the lowest out-of-pocket costs.

Where is Cigna ACA health insurance available in Arizona?

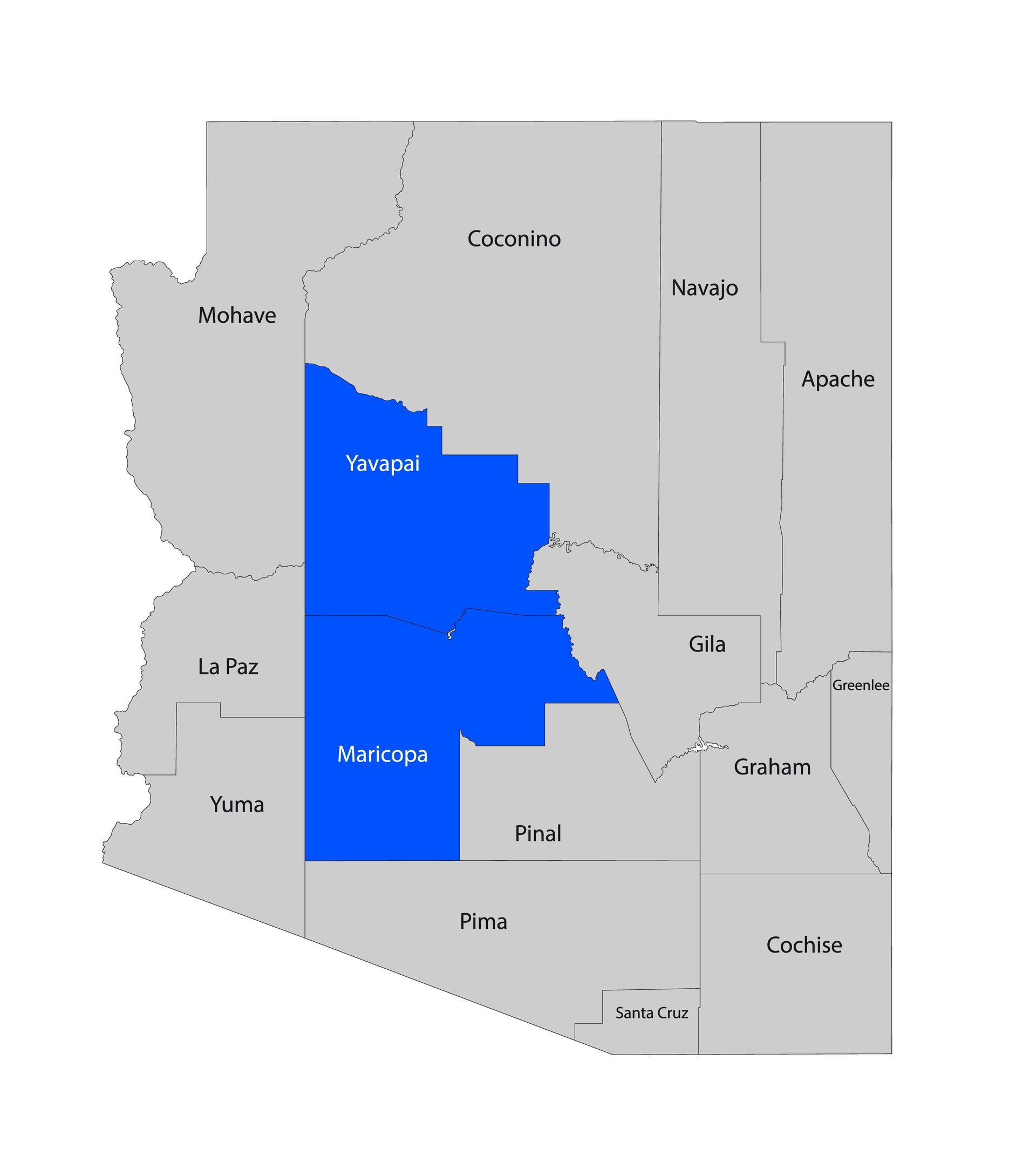

Cigna ACA Marketplace plans are available for individuals and families who live in Maricopa and Yavapai counties in Arizona.

Do you need a referral to see a specialist on Cigna?

No, on Cigna ACA Marketplace health insurance plans in Arizona, you don’t need a referral from a primary care physician in order to see a specialist.

Who’s in Cigna’s lab network in Arizona?

In Arizona, Cigna’s lab network includes Evernorth, Labcorp and Sonora Quest Laboratories.

Which providers is Cigna contracted with in Arizona?

Cigna is contracted with KPC Promise Hospital of Phoenix, HonorHealth, Dignity Health and Barrow Neurological Institute in Arizona.